.png?width=860&height=430&name=Alternatives%20to%20PMCF%20Clinical%20Investigations%20(new).png)

Post-Market Clinical Follow-up (PMCF) is necessary for maintaining medical device regulatory compliance in the EU. PMCF Studies are commonly mentioned throughout the EU MDR and guidance documents.

But a PMCF Study does not always have to translate into an interventional or observational Clinical Investigation.

In a recent webinar, we invited leading MedTech experts from QServe and Greenlight Guru Clinical to share their insights on alternatives to PMCF clinical investigations and suggest ways manufacturers can accommodate clinical data to comply with the PMCF requirements under the EU MDR. Here’s a breakdown of the key takeaways.

Understanding the basics of PMCF activities

PMCF activities play a crucial role in affirming the safety and performance of medical devices as described in the clinical evaluation report. These activities involve collecting post-market user data to assess the device's real-world performance, identify any potential issues, and ensure its ongoing safety and effectiveness. Manufacturers develop a PMCF plan that outlines the specific activities to be undertaken.

PMCF activities can be categorized into two main types: generic and specific.

Generic methods encompass broad approaches for gathering information and typically involve accessing existing data sources. These methods are not device-specific but provide valuable insights into the device's overall performance and safety trends. Some generic methods commonly used in PMCF activities include:

-

Literature and publications, in which manufacturers review published scientific literature and studies related to their device or similar devices.

-

Market feedback, in which manufacturers collect feedback and reports from users, healthcare professionals, and other stakeholders who have experience with the device. This feedback can be obtained through complaint handling systems, customer surveys, or feedback mechanisms.

-

Public sources of information, such as publicly available databases, registries, and adverse event reporting systems.

Specific methods are implemented to proactively gather information on the manufacturer's own device. These are controlled methods, managed by the manufacturer, with the expressed purpose of obtaining data specific to a device's performance. Some examples of these specific methods are:

-

Clinical investigations, such as post-market studies on the device's safety, performance, and effectiveness.

-

Case series and surveys among users to gather information on specific aspects of device performance or user experiences. Case series involve analyzing and reporting on a group of similar cases, while surveys provide structured questionnaires to elicit feedback from a targeted user population.

-

Investigator-initiated studies which serve to evaluate the device's performance or compare it to other devices. Manufacturers can collaborate with these investigators to obtain data and insights relevant to their device.

Overall, PMCF activities encompass a range of methods to collect post-market user data. By implementing both generic and specific approaches, manufacturers can gain a comprehensive understanding of their device's performance, address any potential issues, and ensure its ongoing safety and effectiveness in real-world use.

Factors to consider for your PMCF alternatives

The process of choosing an ideal PMCF activity is just that—a process. Your PMCF plan is not something to be rushed through. It requires care, attention, and time to properly evaluate your options, and the benefits-to-risk ratio of each activity.

As you’re working through these decisions, there are some essential factors to consider.

-

What existing clinical data do you already have? Quality data from earlier clinical evaluations is the best indicator for the level of PMCF data needed for future activities. Depending on how much you need to “bridge” in terms of safety or performance, will impact the choice of PMCF activity selected for your PMCF plan.

-

What gaps do you have in your clinical data? Reviewing your existing data may also reveal areas where you need more complete data. This might include overlooked patient groups, off-label uses, or coverage for device variants in the size or shape of the device.

-

What are the medical device’s classification and reporting requirements? Depending on the medical device class there might be shorter or longer time available to gather enough data for the first PMCF report. Another factor here would be whether the device is categorized as implantable or lifetime.

-

What is the lifetime of your device? The lifetime determines how long you’ll need to follow your patients. In general, the longer the lifetime, the more difficult it becomes to gather complete clinical data.

-

What are the device’s sales volumes and market share? If your sales are not high enough, it can be difficult to collect enough data from observational activities, and may require you to initiate interventional studies.

-

Who is the user of the device—healthcare professionals or patients? How is your device applied in practice? Does it always require intervention/control of clinical experts? If yes, you might not have a possibility to gather data from others than patients.

Regardless of these factors or the PMCF method you choose, one thing is a universal truth: your PMCF activity must be well designed! Is it suitable for your needs? Does it have proper endpoints and acceptance criteria? Is your sample size statically sound? Is the questionnaire optimal in design? All of these will determine the success of your PMCF choices.

Alternative methods for PMCF activities

Now that we’ve covered the differences between general and specific PMCF methods, as well as the factors you need to consider, let’s dive into the alternatives to clinical investigations.

Survey of Healthcare Professionals (HCP)

A survey of HCPs can be conducted as part of PMCF activities to gather valuable information about the device's performance and usage. This approach involves direct contact with providers who have experience with the device, and works best if you have gaps in clinical data on variants, uses, patient groups.

HCP surveys are also useful for detecting off-label use of the device, which helps manufacturers understand the extent to which the device is used beyond its intended purpose. This method may be more applicable to medical devices with a long lifetime, as it allows for follow-up with HCPs over an extended period.

Healthcare Panel Questionnaires/Surveys:

Similar to surveys of HCPs, healthcare panel questionnaires or surveys involve collecting data from a panel of healthcare professionals who have experience with the device.

Most often, HCP questionnaires require sufficient sales and time in the market. That’s because having a substantial user base and a sufficient duration of time in the market allows manufacturers to gather a larger representative sample from the healthcare panel.

Data Collected by Device:

Another alternative is to collect data directly from the device itself, which may contain valuable information on its safety and performance. Data collected by the device, such as usage logs or sensor readings, can provide objective evidence of the device's performance and usage patterns. However, this approach is dependent on the device's capability to collect such data.

Keep in mind that this method also may require scraping healthcare records — which of course establishes appropriate data scraping mechanisms. Therefore, the effectiveness of collecting data from healthcare records depends on the quality and comprehensiveness of the recorded information.

Scientific literature search

Manufacturers can refer to existing scientific literature, including clinical investigations or published data on equivalent devices, to support the safety and performance of their medical device.

If the medical device is equivalent to an already legally marketed device, the manufacturer can reference the clinical data of the equivalent device to support its own device's safety and performance. However, the literature should be relevant to the intended purpose, design, and performance characteristics of the device.

Lay User Cohorts

Lay user cohorts involve collecting feedback and data directly from patients or non-medical professionals who use the medical device. This approach aims to gather real-world information on the device's safety, performance, and usability in everyday use.

When utilizing lay user cohorts, manufacturers should establish a systematic and well-documented process for collecting and evaluating feedback. This may include surveys, questionnaires, interviews, or user experience assessments. The collected data should be analyzed and used to support ongoing device monitoring, risk management, and continuous improvement efforts.

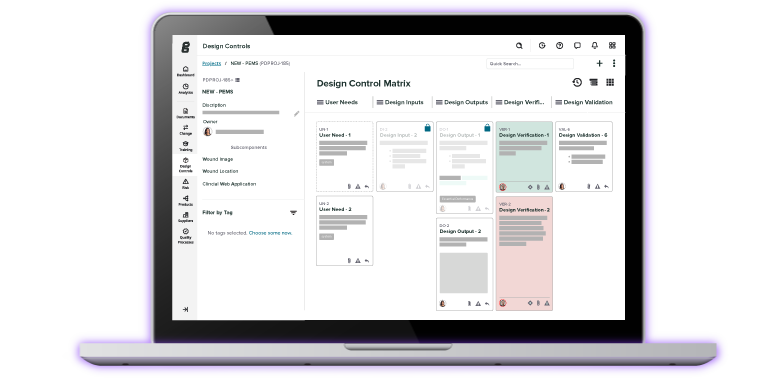

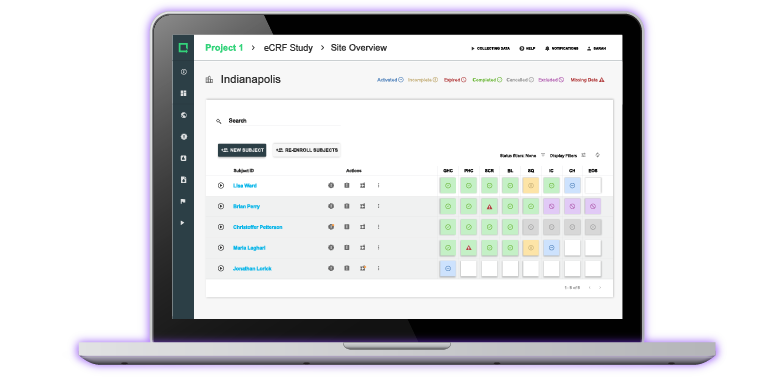

Choose the right clinical data collection solution with Greenlight Guru Clinical

If you’re not partnering with the right electronic data capture (EDC) solution, it may all be for naught.

Greenlight Guru Clinical (formerly SMART-TRIAL) is the only Electronic Data Capture (EDC) platform designed for Medical Devices & Diagnostics. Greenlight Guru Clinical offers the ideal Electronic Data Capture for clinical investigations, performance studies, and PMCF/PMPF activities - including registries and surveys. Our solution is built to empower clinical teams to be their best, and in full control of their data, without compromising on features, design, or compliance.

Contact us today for more information or free personalized demo!

Jón Ingi Bergsteinsson, M.Sc. in Biomedical Engineering, is the co-founder of Greenlight Guru Clinical (formerly SMART-TRIAL). He was also the technical founder of Greenlight Guru Clinical where he paved the way for the platform’s quality standards, data security, and compliance.

Read More Posts

Clinical Trials in 2025: The Outlook for Medical Device Companies

What’s New in Greenlight Guru Clinical 2025.1: Smarter Show Rules and Easier File Vault Access

The Biggest Quality Challenges for Medical Device Companies in 2025

Access the free on-demand webinar

Alternatives to PMCF Clinical Investigations