top takeaways

.png?width=65&name=1%20(2).png)

Covid-19 has changed the funding landscape for medical devices

.png?width=65&name=2%20(1).png)

It's more important than ever that startups have a plan to stand out from the crowd

A solid regulatory and product development plan continues to factor into who is getting the money

Helping you understand what investors are looking for

As the pandemic drags on and its impact continues to be measured and felt in every industry, it's important to recognize the things that still hold true. For medical device startups, one of those truths is that making an impression on potential investors is challenging.

However, there are many strategies and tools that will help to maximize a company's potential. Medical device startups will always have a special place in our hearts here at Greenlight Guru. For that reason, this report doesn't just share the numbers. We also consulted experts to share their best advice and experiences on what investors are looking for and what you can do to prepare.

Our goal is to give you a better understanding of the process of getting funding for a medical device company and to share actionable practices you can begin to use today.

We hope this report will help you on your journey so that we can all continue to improve the quality of life.

50% Completed

Almost there! Please complete this form and click the button below to gain access.

Get your free access to

RAISING CAPITAL FOR MEDICAL DEVICE STARTUPS | 2022 REPORT

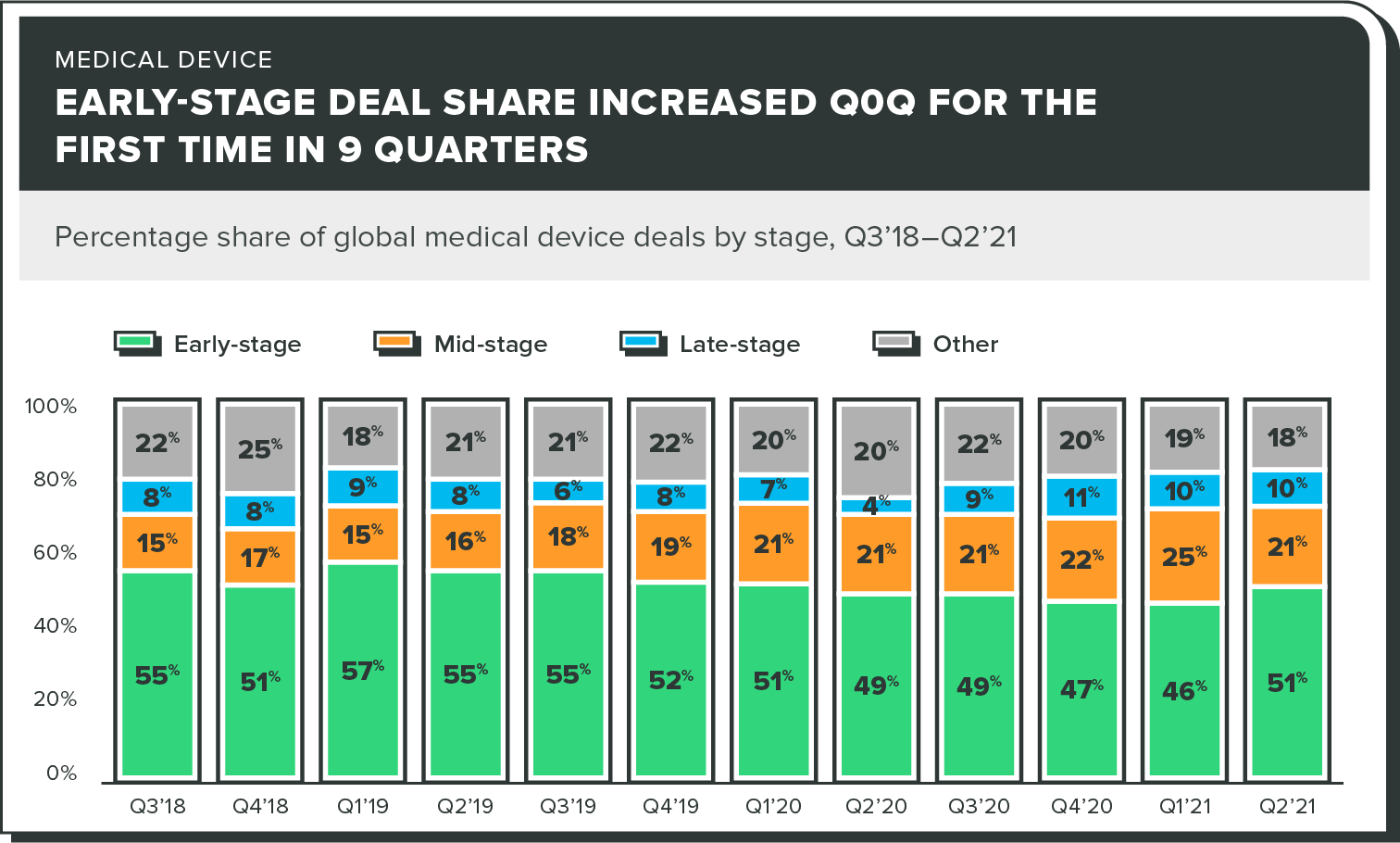

Early-stage deals

After seeing a decline in the number of early-stage deals for 9 straight quarters, Q2 2021 finally saw this number trending upward.

This is great news for medical device startups looking to get a "piece of the pie". Yes, a lot of deals are still going to larger, more established players, but this trend proves that investors are still willing to work with early-stage founders.

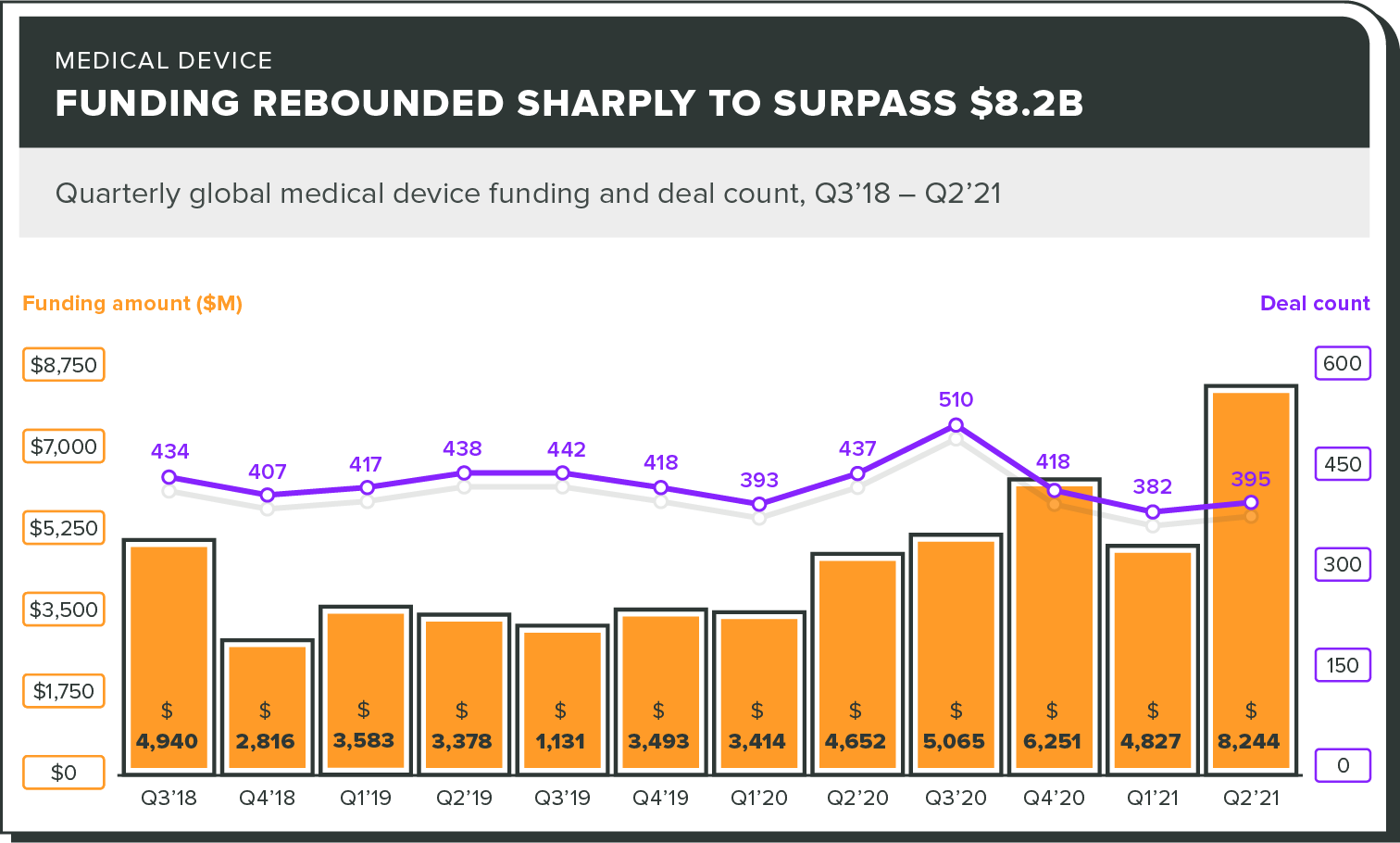

Total funding is up as well

A large increase in the amount of medical device funding in Q2 2021 could signal a rebound from the cautiousness of the pandemic. Yes, this is on the back of a few very large deals to big players, but it's still good news for the industry overall.

So How do I get funding for my device?

What can you do to increase the chances of standing out to potential investors? We talked to experts who shared the best (and worst) things you can do while fundraising.

|

|

Understand your timeline |

|

|

Define your market path

|

|

|

Document your regulatory pathway |

|

|

Network and educate yourself |

-2.png?width=500&height=501&name=GG-LinkedIn-profile-pic-green-1%20(1)-2.png)