How to Communicate Your Regulatory Strategy to Medical Device Investors

In the medical device industry, the regulatory pathway you choose will determine the amount of money and time you need to get your device on the market. Generally speaking, the higher the risk class, the more time and money you’ll require to get your device to patients.

And if you’ve talked to any investors before, you know they tend to be pretty interested in both money and time (specifically, the amount of time before they see a return on their investment).

This blog post will help you understand your regulatory strategy in the context of an investment and how to articulate it to investors in a way that educates them on what you’re trying to do and what it will mean for their ROI.

Understand the type of investor you’re talking to

Knowing who you’re talking to is half the battle when you’re trying to explain your company’s regulatory strategy. There’s a distinct difference between a VC or angel investor that exclusively invests in the MedTech industry and one that invests in, say, steel manufacturing.

And that matters, because you’ll need to do more work educating some investors about your regulatory strategy.

If you’re speaking to a typical MedTech investor with plenty of medical devices in their portfolio already, then you can be fairly confident they’ll understand many of the broader implications of your regulatory strategy.

On the other hand, an investor who may be making their first foray into the MedTech space will need a lot more education. You can’t take it for granted that they understand what it takes to complete a PMA submission for a Class III device—or why that will be worth the lengthy timeline.

There’s more nuance to this dynamic, of course. If you’re a software as a medical device (SaMD) company, then a typical, more traditional MedTech investor may not be as familiar with subscription models for revenue and how that changes the timeline for their ROI. Maybe an investor outside of MedTech, like a typical SaaS investor, would be a better fit, even though they’ll need more education on the regulatory side.

The bottom line is that you have to know who you’re speaking to and how their knowledge and experience will affect how you present your regulatory strategy to them.

Educate investors on your medical device’s timeline and why you’ve chosen this path

Okay, so when I say you need to “educate” them, what does that really mean?

Well, let’s break it down by what investors care about the most, i.e., when they’ll get a return on their investment. We know that the type of device you’re making will inevitably affect that timeline, because with greater risk comes greater responsibility. A Class III device in the US, for example, requires premarket approval (PMA) from FDA.

And these high risk devices are the most difficult to get to market. At True Quality 2022, Sandra Rodriguez, Senior Industry Analyst at Axendia, Inc., shared research with attendees that showed Class III devices require an average of about $17 million and 80 months to get to market. She compared that to Class I devices, which are usually exempt from premarket notifications and generally take about $2 million and a year or two to get to market.

The ideal regulatory path is unique to every device. Which is why it’s part of your job to help investors understand why you’re choosing your path and what it will mean for your timeline.

I recommend creating a visual representation of your development timeline and milestones, like completing design controls, verification and validation, and approval or clearance. Don’t leave off the less flashy items, either. Milestones like biocompatibility testing or sterilization and packaging may not seem like a big deal when you’re planning, but they absolutely will have an impact on your timeline.

By laying out those planned activities on a timeline, you make sure that everyone in the room is on the same page. It also turns an abstract concept like “five years” into a series of specific goals that ladder up to the goal of bringing your device to market and keeping it there.

Don’t forget about quality when presenting your regulatory strategy

When people talk about a regulatory strategy, they’re often quietly placing quality under that same umbrella.

Personally, I think it makes sense to separate the two. If you’ll forgive a sports analogy, I like to think of regulatory as playing offense and quality as playing defense.

What I mean by this is, regulatory is about setting a path, learning what you need to do to make it down that path, and then executing. You’re calling plays and heading for the other end of the field.

Quality, on the other hand, is defensive. It’s about preventing as many issues as possible and mitigating the ones that inevitably crop up. On the one hand, you’re protecting your company from findings during audits and inspections.

Of course, quality is about more than just that. By following your SOPs, documenting your actions, and establishing closed-loop traceability, you’re protecting users and patients from mistakes or oversights.

And while your regulatory strategy may get a lot of scrutiny from investors, I’ll let you in on a little secret—the quality side of the QA/RA coin is just as important to many investors.

Why? Because your QMS determines how easy it will be for your company to eventually be acquired (or grow into a big company in its own right).

Investors don’t want to see stacks of paper. They want to know you can survive an audit and that you won’t be stuck under a warning letter for years. Not everyone knows this, but most medical device companies are acquired postmarket. The companies that get acquired have taken a product to market, tested the waters, and validated that the market cares about their product.

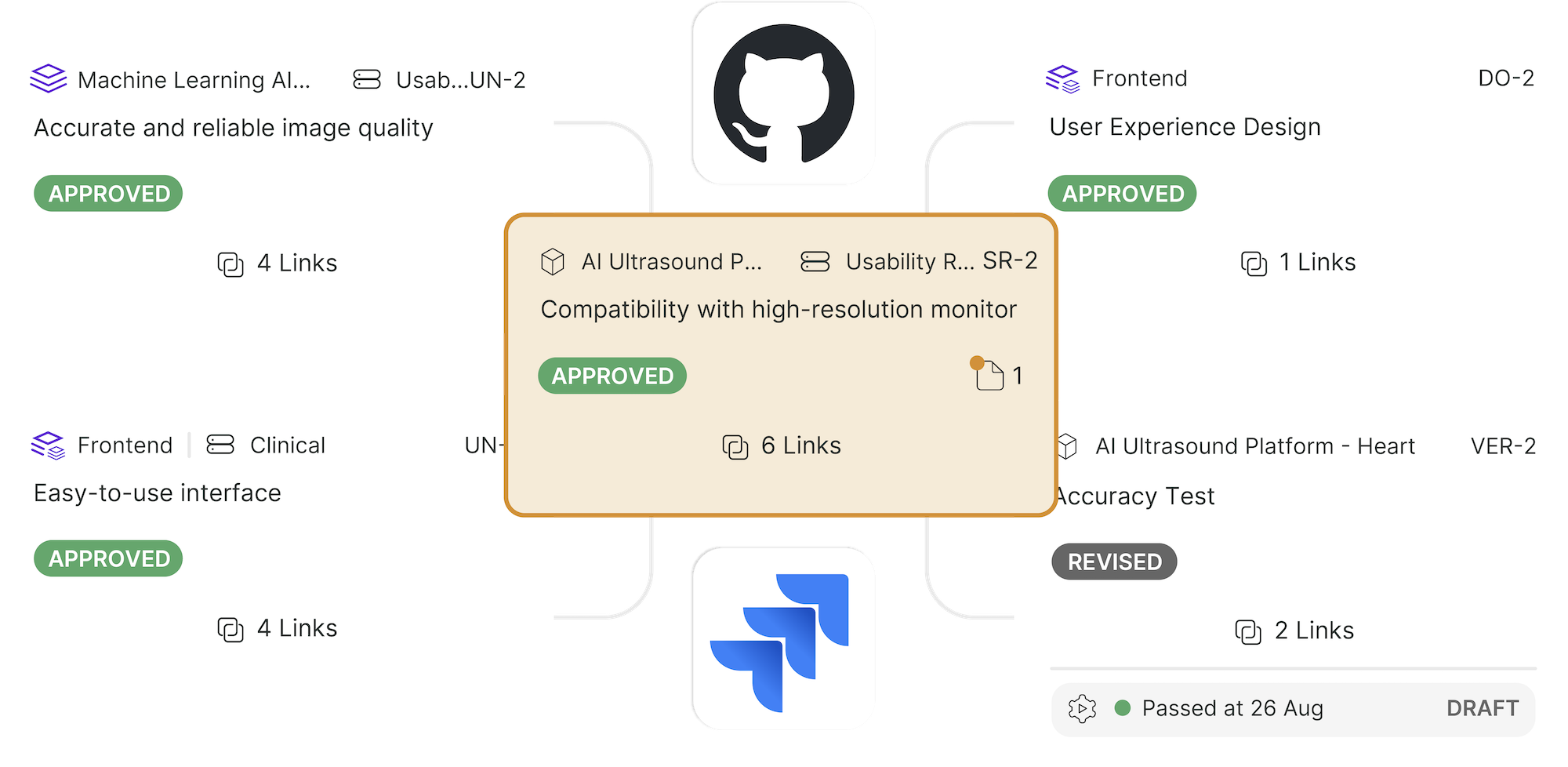

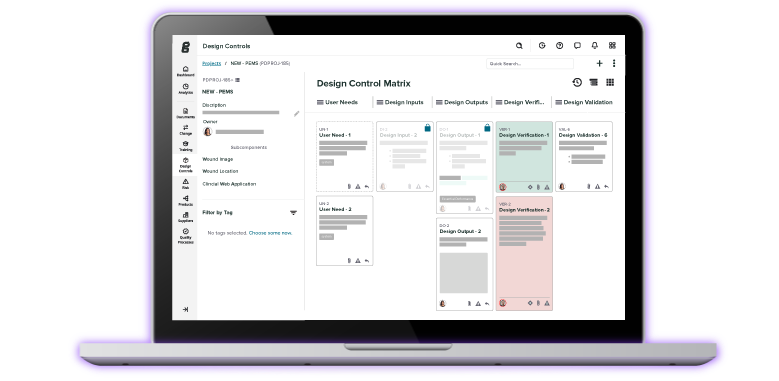

Savvy investors understand that a company using an end-to-end, QMS platform has a much better chance of not only getting their product to market, but being acquired later on.

Greenlight Guru’s MedTech Lifecycle Excellence Platform is with you every step of the way

Want investors to take you and your company seriously? Prove to them that you take what you do seriously by using a medical device-specific solution that’s built to support you from your early strategy sessions all the way through postmarket surveillance.

That’s exactly what Greenlight Guru’s MedTech Lifecycle Excellence Platform offers you—an end-to-end platform that takes you beyond baseline compliance and into the realm of True Quality.

Sometimes it’s the investments you make in your team and your company that pay the greatest dividends later on, so get your free demo of Greenlight Guru today.

Etienne Nichols is the Head of Industry Insights & Education at Greenlight Guru. As a Mechanical Engineer and Medical Device Guru, he specializes in simplifying complex ideas, teaching system integration, and connecting industry leaders. While hosting the Global Medical Device Podcast, Etienne has led over 200...

Read More Posts

What is a Class III Medical Device in the US?

Building a Partnership with your Regulatory Consultant

Developing a Regulatory Strategy

Get your free PDF

Checklist: What Medical Device Investors Want to See