5 Signs Your MedTech Startup is Ready for the Next Round of Funding

Medical device startups are one of the greatest sources of inspiration in the MedTech industry.

Why? Because within these companies, there are countless innovators and innovations that continue to fuel the advancement of life-saving and quality of life-improving devices on the markets of today and tomorrow.

However, with so many startups looking to build a full-fledged initial public offering, there is a lot of competition. And taking those precious next steps forward needs to happen at the right time; jump in too early, and you may find your financial future in question before the device ever comes to market.

Late stage investors are looking for devices that are not only profitable, but have the potential to deliver big time breakthroughs to the industry as a whole. With that in mind, here are five signs your medical device startup is ready for that next round of funding.

#1: Medical device technology is unique and transformational

One of MedTech’s biggest draws for investors is its penchant for boundary-pushing, groundbreaking technology. Whether it’s diagnostics, robotics, or AI technology, medical device manufacturers routinely develop innovative new products that can help extend and improve the quality of life for its users.

But while everyone loves a moonshot - i.e. an exploratory project without any focus on a financial return - MedTech startups don’t have the luxury of endless funding and time. That being said, there are different kinds of transformational MedTech breakthroughs that may still earn you more late-stage funding. One example can be found in the distinction between radical or disruptive innovation and incremental innovation.

The concept of incremental innovation refers to a series of minor improvements made to a company’s product or services. Normally, this would apply to a company making tweaks to its own products.

However, in the medical device industry, these kinds of iterative improvements can be developed by any company. This is something we commonly see with the 510(k) submission route, a pathway designed for improvements made to existing device types.

The point, here, is to not underestimate the impact or importance of your startup’s tech when pitching for late-stage funding.

#2: Your medical device technology is in high demand

MedTech is a massive industry, with a huge range of medical device types, patient populations, and areas for growth. These factors, combined with global health events and a growing elderly population, means no shortage of opportunities for MedTech innovators. And while the MedTech boom can be felt industry-wide, there are a few sectors in particular that have investors lining up in droves.

One area of note is the digital health sector, which comprises areas such as mobile health, home diagnostics, health information technology, and wearable devices. These kinds of technologies provide solutions for some of the most pressing needs in healthcare, such as:

-

Telehealth and telemedicine

-

Supply chain management

-

Robotic surgery tools

-

AI-assisted pathology tools

-

Opioid addiction treatment

While digital health has garnered a large share of attention, it’s not to say that traditional medical devices are lagging too far behind. Increasing investments from government bodies and private investors in healthcare sectors are still creating new growth opportunities for this market.

A recent study identified the top 10 medical device technologies market types as:

-

In vitro diagnostics (IVD)

-

Cardiology

-

Diagnostic imaging

-

Orthopedics

-

Ophthalmology

-

Endoscopy

-

Diabetes care

-

Wound management

-

Kidney and dialysis

-

Anesthesia and respiratory

As your medical device startup looks ahead toward the future with investors, be sure you’re striking while the iron is hot as well as including market projections or new applications for your technology when pitching for late-round funding from investors.

#3: Your medical device has real advocates in the field

Another surefire sign that your medical device startup is ready to move forward with late-stage investors is having user buy-in. Many medical devices are developed after speaking directly with doctors in the field, such as within surgical departments in hospital organizations.

And while having individual or single teams of supporters can help to shape the product design, it looks even better when you have multiple champions in the field benefiting from your device.

A helpful metric in determining growth potential for investors can be found in the results of clinical testing needed for certain regulatory submissions. Not only can this data provide proof that the device you’ve designed is working properly within the field, it can also be mined to illustrate the potential for new patient populations, indications for use, and areas for improvement throughout the device lifecycle.

If you’re having trouble getting your device into the hands of actual users, there are a couple good approaches to increase market visibility. For one, you may want to return to your product’s users needs and identify different types of end users and beneficiaries. Some good questions to ask in this process are:

-

Who is the user?

-

Who are the beneficiaries?

-

Is the device operated by the actual patient?

-

Are there additional users who may help in setting up devices?

Be sure to consider the multiple sources for potential testimonies, and ensure that your post-market data collection practices are connected to both your risk and design matrix.

#4: You have a MedTech investor you can trust

Bringing a medical device to market, especially before a company goes public, requires a tremendous amount of upfront capital. That means seeking out investors, strategic partnerships, and grants as a way of funding the company until the device is generating revenue.

But with so many different sources of funding, and different types of investors, it means that finding the right fit with your MedTech investor is paramount to the success of your startup. Before engaging with any mid-or-late stage investors, you’ll want to be absolutely sure you perform your due diligence in vetting them.

Some helpful activities in vetting your MedTech investor include:

-

Speaking directly with other companies they’ve funded

-

Looking at their second and third-round investments

-

Understanding what role they want to play in your company’s growth

-

Asking them about their visions to make sure they align with your own

-

Outlining expectations and what key metrics they’re interested in

Most importantly, though, is to find an investor who understands the importance of your work. Bear in mind that they may still need to rely on subject matter experts to understand how your technology works.

But, overall, they should have a shared passion for helping patients by improving the quality of life for all involved. Once you’ve established a strong connection in this department, it may very well be time to move forward in the fundraising process.

#5: You have a medical device specific solution that scales with you

Once a company approaches an IPO or goes public in any other way, things should start to move very quickly. That’s why investors are so focused on a startup’s ability to scale over the coming years. So, when the next round of funding for your MedTech startup comes calling, you’ll want to be absolutely certain that your quality management system (QMS) is not only in place, but built to scale with you.

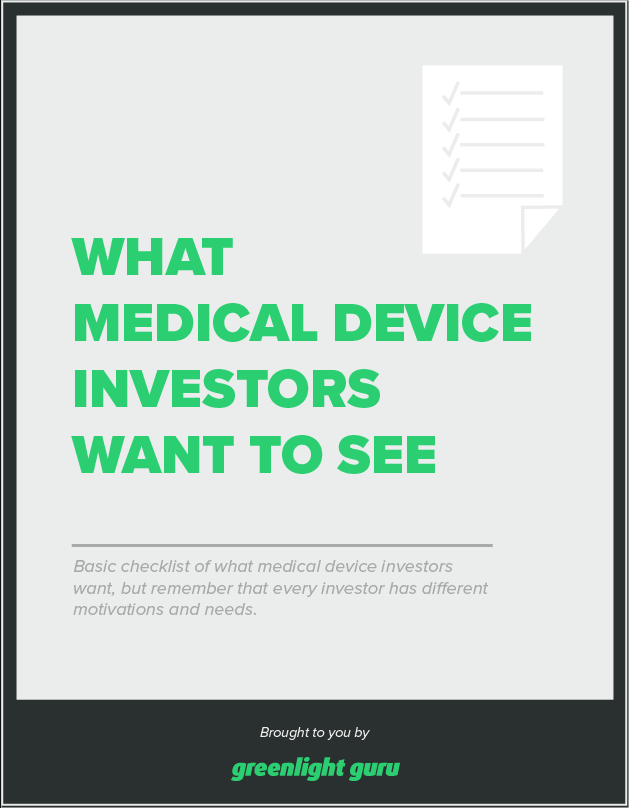

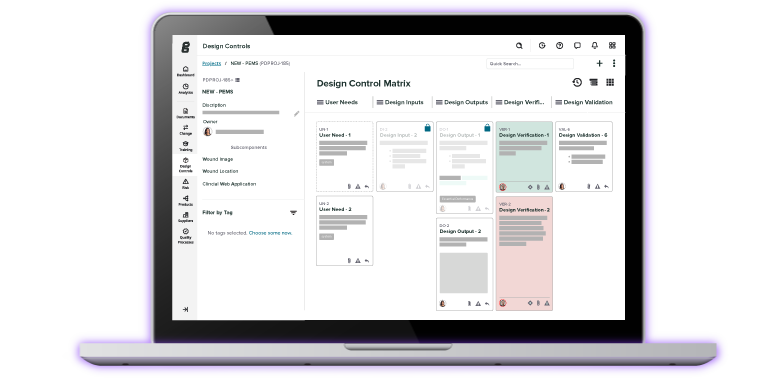

Unfortunately, too many MedTech startups are stuck using an outdated paper-based quality system, rather than a QMS purpose-built for the medical device industry. This type of solution, like the MedTech Suite from Greenlight Guru, connects all design controls, risk management, documentation, and regulatory submissions in one convenient and centralized location.

And with the majority of MedTech startups failing to bring a device to market, it’s clear that accelerating the delivery of life-changing devices is a perilous thing. So, why not partner with the only end-to-end platform designed to support medical device companies throughout their commercialization journey?

Greenlight Guru is the signature medical device industry-dedicated quality and product development platform. In fact, it’s the only software with the latest FDA and ISO best practices specific to medical device companies built into every feature.

Wherever you want to go, we want to support you along your journey in helping improve the overall quality of life with your medical device. If you’re ready to get started, contact us today for your free personalized demo →

Etienne Nichols is the Head of Industry Insights & Education at Greenlight Guru. As a Mechanical Engineer and Medical Device Guru, he specializes in simplifying complex ideas, teaching system integration, and connecting industry leaders. While hosting the Global Medical Device Podcast, Etienne has led over 200...

Read More Posts

MedTech Funding and Preparing for Due Diligence

MedTech Advice from an Accidental Entrepreneur

From Academia to FDA Clearance (True Quality Roadshow - Boston)

Get your free PDF

Checklist: What Medical Device Investors Want to See