There’s no doubt that MedTech is a noble industry, built on the mission of improving the quality of life with impactful medical devices.

All that said—it’s still a business. And in order to succeed, medical device companies have to find a way to eke out their place in a market that’s as competitive as it is crowded. Building quality devices is a good start, but companies need to be strategically managing their product portfolios.

A well-managed portfolio helps medical device companies balance risk and reward, optimize their resources, and stay ahead of the curve in a fast-evolving industry.

To that end, here are four tips for managing your MedTech portfolio that can help you navigate the challenges and opportunities ahead.

Get to know the fundamentals of managing product portfolios

Managing a company's intellectual property (IP) is a complex process that requires attention to both innovation and strategy. This means taking ideas generated by the R&D team and transforming them into valuable assets, and aligning the R&D output with the sales and marketing strategy of the company.

When done correctly, this process may ensure that the resulting products meet the needs of customers and effectively compete in the marketplace. That being said, it’s crucial to undeÍrstand what kinds of assets make up a typical MedTech portfolio, and the best practices in managing them properly.

In general, MedTech portfolios should contain all four types of IP:

-

Patents, such as a medical device, its components, and overall design. Patents have a lifespan of 20 years.

-

Copyrights, such as written materials, video productions, images and graphic designs. These last for the entire lifespan of the creator, plus another 70 years beyond that date.

-

Trademarks, such as company and product name, slogans, and domain names. Trademarks do not expire, so long as the owner continues to actively use the trademark.

-

Trade secrets, such as patient data, negative research, or unique documented insights. These also do not have a specific expiration date, at least as long as the information is kept confidential.

Establish a team to oversee your medical device portfolio

Managing a product portfolio requires a clear and singular vision, one that unites your product development, marketing, and sales teams. To do so, start at the top with your portfolio’s leadership.

This is an oft-overlooked step, as many medical device companies take a by-committee approach to their product portfolio. Or worse, they give ownership of the portfolio to someone who lacks proper financial experience, such as a chief technology officer or lead engineer.

While these folks are no doubt knowledgeable in their respective areas, they may be too product-minded. Not only that, these are also employees with their own busy schedules, resulting in a deprioritization of portfolio management duties. The end result is squandered potential for the commercialization of your products.

Instead, the portfolio owner should be someone with a cross-pollinated background in technology, life sciences, and business, who can balance these perspectives and make strategic decisions that align with the company's goals. They should also have the necessary authority to not only communicate decisions, but also to enforce them.

In addition to your portfolio’s manager, you’ll want to involve trusted sources for insight into your IP. A common practice for medical device companies is to hire in-house patent attorneys, whose sole responsibility is advising portfolio leadership, or even managing the portfolio entirely. However, it’s particularly important to choose those with proven experience in a regulated field like MedTech.

Assess the value of your MedTech portfolio

Evaluating the IP of a company's product portfolio is a critical step in assessing its value, protecting it from infringement, and securing its future profitability. However, this process can be easier said than done. Assigning a dollar amount to something as intangible as innovative technology is difficult, especially for devices with long product lifecycles.

These types of evaluations are typically accomplished through one of three methods: the cost method, the market method, or the income method.

Cost method

The cost method is a straightforward way to evaluate the value of a company's IP. It involves calculating the cost of developing the IP and any related assets, such as utility or design patents, trademarks, and copyrights.

The cost method is ideal for evaluating the IP of products that are still in development, as it focuses on the resources invested in bringing them to market.

Market method

The market method involves evaluating the value of a company's IP based on market data. It looks at the prices of similar products or services in the market to determine the value of the company's IP.

The market method is ideal for evaluating the IP of products that are already on the market, as it relies on actual market data rather than estimated costs.

Income method

The income method involves evaluating the value of a company's IP based on its income-generating potential. It looks at the future revenue or earnings that the IP is likely to generate over its lifetime.

The income method is ideal for evaluating the IP of products that are already on the market and have a track record of generating revenue.

Foster a culture of MedTech innovation

Innovation is a cornerstone of the MedTech world. As such, effective portfolio management in the medical device industry demands a relentless focus on innovation. Cultivating a culture of creativity, collaboration, and risk-taking is more than just corporate buzzwords—it’s a commitment to an environment that prioritizes continuous improvement, encourages exploration of new technologies and markets, and supports R&D activities.

Medical device companies should allocate resources to continually enhance existing products, create new ones, and outpace the competition. Maintaining a robust R&D pipeline ensures a steady stream of innovative products that can adapt to the evolving needs of customers. Furthermore, R&D investment safeguards a company's intellectual property portfolio and protects their market position.

But as the old adage goes: if a groundbreaking device is invented and no one is around to patent it, is it still innovative?

It’s so critical that you have the proper processes in place to capture early and potential patents that are developed within or acquired by your organization. This can take the form of an easy-to-use invention disclosure form, allowing employees to help capture and keep track of the inventive developments.

Identifying the potential sources for innovative products is another excellent way to generate potential portfolio additions. Some common sources include:

-

Physicians or surgeons who need a device that doesn’t yet exist

-

Hospitals and universities, where device ideas come out of clinical research

-

Incubators, where small startups seek investment or acquisition to bring devices to life

Lastly, innovation isn’t just for new products, either. Current products’ designs may undergo significant changes during the initial concept-to-final product development process. Thus, while it's crucial to file for a patent early, it's also recommended to consistently be testing and brainstorming possible alternatives, as a path to more robust initial patent filings.

No MedTech portfolio is complete without a connected QMS solution

Building a successful and robust product portfolio involves so many parts of your business. Product development, manufacturing, lifecycle management—these are just some of the essential activities along the path toward commercialization.

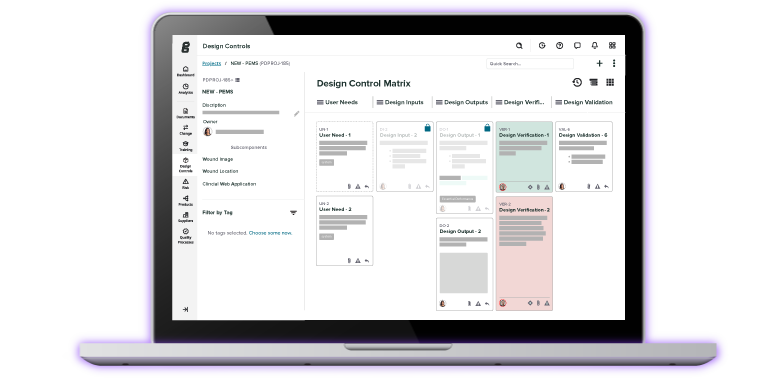

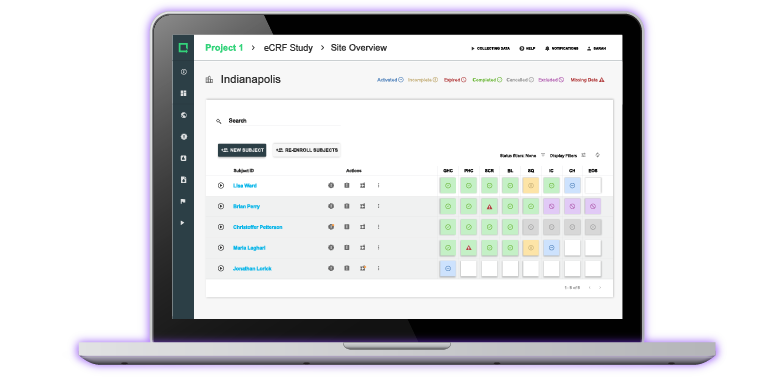

With so much at stake, you’ll need a connected system that drives collaboration, promotes traceability, and makes key information visible.

That’s where Greenlight Guru comes in. As the only platform created and dedicated to MedTech Lifecycle Excellence, Greenlight Guru helps close some of the execution gaps standing between you and unparalleled success as you continue to develop and expand your product portfolio.

Ready to learn more? Get your free demo of Greenlight Guru today →

Etienne Nichols is the Head of Industry Insights & Education at Greenlight Guru. As a Mechanical Engineer and Medical Device Guru, he specializes in simplifying complex ideas, teaching system integration, and connecting industry leaders. While hosting the Global Medical Device Podcast, Etienne has led over 200...

Related Posts

Top 20 Medical Device Venture Capital Firms

Enabling MedTech Innovation through Cross-functionality

MDSAP Approach - Navigating the Medical Device Single Audit Program

Get your free resource

Checklist for Protecting your IP throughout the MedTech Lifecycle