The Future of Reprocessed Used Medical Equipment

What’s accelerated the growth of online healthcare device sales, and what’s the future of regulation regarding selling used medical devices? In today’s episode, we spoke with Scott Carson on the future of buying and selling used medical devices.

Scott has been in healthcare marketing, business development, sales, and management experience for more than 30 years. He was on the team that built the eBay Healthcare Marketplace structure and founded US Medical, Inc., the first Internet distributor of new and pre-owned capital medical equipment to the healthcare industry. Although he started US Medical in his basement, it became a member of the Inc. 500 five years later.

Listen to the episode to learn about what’s accelerating the market for used medical devices, what the future of reprocessing used devices will look like, and what facilities already working towards reprocessing devices should be thinking about.

Listen now:

Like this episode? Subscribe today on iTunes or Spotify.

Some of the highlights of today’s show include:

-

Why the medical devices may now be keeping up with online communities

-

The impact online medical devices sales has on regulators

-

The scope of medical healthcare devices on eBay vs. Alibaba

-

The path forward for early-stage manufacturing companies

-

How manufacturers should think about the entire life cycle of devices, including resale

-

How to think about the used market from a global standpoint

-

What practical regulation to curb the bad actors in the market would look like

Links:

Memorable quotes from Scott Carson:

“Probably the single biggest accelerant was actually the pandemic.”

“The entire worldwide community is completely flatfooted and stuck and not even aware what’s occurring – in my view doesn’t even understand what’s occurring and how they’re going to start to regulate this.”

“eBay is mostly what we call – and you may know this phrase – spray and pray. Spray with Windex and pray that it works. And that is not a regulated process.”

“I think manufacturers need to change their position and think about the profitability of maintaining and supporting that through the (online) channel and the life of the product in the (online) channel.”

Transcript

Announcer: Welcome to the Global Medical Device Podcast, where today's brightest minds in the medical device industry go to get their most useful and actionable insider knowledge, direct from some of the world's leading medical device experts and companies.

Etienne: Welcome back to the Global Medical Device Podcast. My name is Etienne Nichols and I'm the host of today's episode. In today's episode, we spoke with Scott Carson on the future of buying and selling used medical devices. Scott has more than 30 years of healthcare marketing, business development, sales, and management experience. He was part of the team that built the eBay healthcare marketplace structure, and he's nationally recognized as a leader and speaker in driving sales through internet transactional platforms. He founded US Medical, the first internet distributor of new and pre- owned capital medical equipment to the healthcare industry that started in his basement. US Medical emerged five years later as a member of the Inc 500. Scott was named a finalist twice in the Ernst and Young's Entrepreneur of the Year award competition and has been twice named among the Inc 500's fastest- growing companies. Scott has a lot of insight into some of the changes and the challenges that this industry is facing, and he's already started working towards implementing solutions to these challenges. We covered a lot of ground, but one of the interesting things I heard in this conversation was that there's already a used market for medical devices, so what will the future of reprocessing those used or providing, distributing those used devices look like? If you have something to add on this topic after the episode, we'd love to hear it. Head over to the community and join the conversation community. greenlight. guru. Now onto the show. Please enjoy this episode with Scott Carson on the future of buying and selling medical devices. Hey Scott, welcome to the show.

Scott: Hey, thanks for having me. Appreciate it. Been looking forward to this for several days, and anxious to dive in and meet and discuss some of the things we've kicked around already.

Etienne: Yeah, so we were talking a little bit, before we hit record, just some of the things that we want to talk about. You mentioned voice of aesthetics, a voice of reason in aesthetics, and maybe before we even go into the details about that, I'd like to hear some of your story. We've talked a little bit about how you helped build the healthcare marketplace for eBay, so obviously you have a lot of experience in these online communities. I wonder if you could give some background in these online communities and maybe some of your background and your experience building through those things.

Scott: Sure. This is really going to age me, but my digital experience actually started in what was called fax- back or fax- backing. And what that was was the early digitization of content to purchasers, whether it be clinicians or administrators. And this is where they could call a number that was given to them in some form of print media or some type, could be a flyer, direct mail piece, a trade show, and they could call this number and they could choose a number, 1 to 100, for example, based on the menu. And then information would be delivered by facsimile to the recipient about a product or a service, and so they could get some customized detail. And that was basically in the late'90s and early 2000s, and there was a lot of FTC regulations that were happening about broadcast faxing and that kind of information. But at the same time, this thing of the internet was happening and there was this giant gold rush. We can all look back now and look at that and see what transpired. But obviously healthcare being this mammoth global industry, literally hundreds of millions of dollars at the time, was invested in trying to create efficiency in every aspect of healthcare at the time. And this is in the late'90s, early 2000s. And in the devices and pharm and med surg, there were literally hundreds and hundreds of companies and roughly seven to ten front runners raising hundreds of millions of dollars, building infrastructure, and trying to create adoption and traction on the internet for healthcare. And some of you that have been around a while may remember the only company that really made it public was Neoforma in trying to deliver this experience. And every one of them, of those seven to ten from Medibuy to US Medical that I was a part of and so many others, actually didn't make it out because healthcare really at the time wasn't ready to make that change. What people misunderstood at the time is that healthcare moves very, very slowly. Adoption is very antiquated in the way they go about it, and it just doesn't move quick. And I think that was really the biggest miss. And it's now at a place where I think we're going to see rapid evolution of adoption to healthcare platforms of the purchasing, education, demonstrating, delivering, all the way through to the patient use and experience, is going to happen incredibly rapidly. Probably within the next five to seven years, the landscape on how products and services are delivered will look nothing like it does today.

Etienne: So you mentioned that the medical device and a lot of the different healthcare things, they move slowly, and I think that's going to be a familiar concept to anybody listening to the Global Medical Device Podcast. I'm sure they're familiar with that. That being said, I completely see where you come from. The internet and a lot of this technology moved fast. We had almost an exponential growth curve, well, probably an exponential growth curve as that technology started to be adopted. But like you said, the medical devices were a little bit slow. They weren't keeping up. But now they've maybe reached a point... Why would that be the case? Why in the next five to seven years do you see that adoption happening?

Scott: Probably the single biggest accelerant was actually the pandemic. And I was thinking more 10 to 15 years prior to the pandemic, but early in the pandemic experience, within a matter of weeks to months, I was speaking and talking throughout the industry about this is going to change everything and speed it up. And we're starting now to see some of that data become really apparent. And I'll give some examples within the industry and outside of the industry of healthcare. Within the industry, we saw Pfizer at the beginning of this year reduce 1% of its worldwide sales force moving to digital tech stacks. We saw Amgen in February removing 500 sales reps, with a movement to more digital content and information. We've seen, outside of the industry, Ford that was selling 8% of its cars online now moved to over 30% in the last few months online. There is rapid changing occurring in how we make purchases and in our consumer and in our B2B lives in and outside of healthcare, because the pandemic showed us that we don't need to go to the car dealership to buy a car. We don't need a sales rep to be in the office or be in the clinic or in the hospital. In some cases, if you think about it, hospitals restricted completely sales reps during the pandemic from coming in the hospitals. And I think they realized somewhat intuitively and then factually, consciously later on that, wait a sec, we still operated without sales reps. And so there's something that has occurred that was a real shift. And then I'll just explain something. If you think about this positioning of healthcare devices, pharma, and supplies, med surg, is if you think about every aspect of our life, we purchase things. Nobody really sells us anything. I purchase a seat on an airline, and I have choices. I go to Airbnb and I look at reviews and photographs and location and pricing, good, better, best, lowest cost, best location. I make a decision to purchase. Through social influence, I choose the clothes that I wear or the glasses that I have on or the shoes that I have on, what restaurants I'm going to do. I use OpenTable or Yelp or some other platform to guide me on the cost and the experience that I'm looking to have. But if you think about it in healthcare, everything is pushed still. Everything is sold. Everybody's got the best product and the best technology and the best solution, and almost every website of a manufacturer or service provider is very marketing- oriented and very lack- of- data- positioned, and there surely isn't any comparison positioning between their competitors. Why would they do that? And then if you look at that roughly any manufacturer will tell you that sales and marketing roughly is 40% to 50% of the sales cost of a product, and if you could find a way to eliminate that and provide a lower cost to the customer and a longer warranty and greater profitability to the manufacturer to support longer warranties or greater experience or maximize uptime, you've got a massive amount of margin that is sitting there that needs to be compressed. And whether people think I'm right or think I'm wrong, where you find 40% to 50% margins in massive industries that don't necessarily need to be there through people, they're going to get wiped out. And we're starting to see some of this. I'm not going to speak specifically to the industry, but I'll note it's in vision and it's in the UK, and a large retail operator of vision technology was buying through distribution, which has been the way that they've purchased for decades. And they just woke up one day, this retail provider of this implantable device and said, " Why don't we just go make a deal with a manufacturer directly?" And they reduced their cost by 30% by eliminating the distribution stack that existed. So I think what's occurred with the pandemic just created an optic of you that was going to be there anyway. It just made it happen faster. And then the last thing is, what people don't recognize is, in my later'50s... And I adopted technology. I was not a technology native. And so I still have one foot firmly planted in my purchasing decisions based on the way things have always been done. Now, I've adopted the way I choose to buy things through technology. However, the 35- year- old administrator that's now in a purchasing decision, authoritative position, or a physician or clinician that's now starting to make purchasing decisions, they are digitally native and they expect that they're going to have good, better, best, lowest price, peer- to- peer reviews, uptime, serviceability, ongoing service costs, parts costs. They don't want to interface with a rep that has the best product. They want to look at the data as they do at every other aspect of their purchasing lives. And they don't understand that there was a way that it was done before technical stacks, and they're going to force this. Regardless of what I do, it's going to happen anyway.

Etienne: Yeah, you make a really good point. It's interesting that you bring up the adoption versus native. So I might have been one born out of due season. I'm not exactly sure. My mom was a computer technician, so I can remember every one of us kids had a computer since the time we could walk. And that just seems foreign to me otherwise. You brought up the cars. I've been complaining to my wife for years, why can't I just go online and tell them exactly what I want and they deliver it to my door? That's the way it ought to be. But you're right. We just assume, well, medical devices are different, but maybe not. So if I were to turn this into a question, though, what is the impact to regulators? We might think, okay, well, they got to change how they buy things. Okay, well, that's going to impact marketers. It's going to impact sales people for sure. It's going to be a difference there. But what about regulators? Is there an impact to those people and how some of these devices are regulated? Do you see any things like that?

Scott: No question. We are in, from a regulatory, compliance, tracing, everything that you guys are all about, the entire worldwide community is completely flatfooted and stuck and not even aware what's occurring, in my view doesn't really understand what's currently happening and how they're going to start to regulate this. And I think everyone that's listening to this realizes that all markets globally are being flooded through platforms like Alibaba with unregulated, counterfeit, non- traced, unknown origin devices, pharma, med surg. And it is rapidly becoming overwhelming at the borders around the world of how to manage this stuff. Counterfeit devices in the US and throughout North America have become almost epidemic. And Alibaba is just one platform, and you're going to see thousands of marketplace platforms being created. They haven't really had much success. And in some cases, certain marketplaces have either restricted or not allowed devices or pharma. Amazon, being fully capable of doing it, hasn't really allowed anything but lab or beauty, surely hasn't gotten into devices or pharma. And we all know in this industry, Amazon is deeply involved in looking at this to compete against the GPOs and eBay, even though they're a strong marketplace of roughly 700 million a year, 97% of it being pre- owned, 3% of it being new. They've substantially restricted that growth for a lot of different reasons. But if you think about just eBay, a$ 700 million unregulated marketplace, that's astounding that there's no regulatory oversight.

Etienne: Yeah. So tell me a little bit more about how that works. When you said the healthcare marketplace, I'm not very familiar with that, to be completely open with you, on eBay. So what is involved there and what's the difference in that... We already mentioned Amazon doesn't have a lot of either device, pharmas, and so forth, but what is the scope of healthcare marketplace on eBay versus Alibaba? Can you speak a little bit to that?

Scott: Sure. There's a whole range of marketplace, maybe... I was trying to think of the right way to say it, as success or lack of success or lack of adoption or just lack of use. And let's use eBay as an example. Early on, eBay was a marketplace of Pez dispensers and Beanie Babies, which were really called practicals, was that category. It evolved to... Excuse me, collectibles. It evolved to practicals, practicals being golf clubs and washing machines. There was an alliance at the time with Craigslist, which most everyone's aware of, and I won't go into too much detail about that, but everyone knows that Craigslist was an early online garage sale and continues to be that to some extent. And eBay started to look at different sectors in which they could be successful, tractors, yellow wire like Caterpillars and bulldozers and real estate and automotives and healthcare. And the list was somewhat endless because they figured if we can get trust in a category like collectibles and then we can migrate to golf clubs and fashion tennis shoes, we'll be able to do it in other sectors. And in some cases they were very, very successful. In other cases, they failed completely. And then in some cases, they just didn't allow it. A lot of marketplaces, for example, don't allow firearms. So in some cases they just said, " You know what? We're not going to play." But very few people know that, and I'll use, when you talk about a marketplace, to give people some perspective of what a marketplace is and how it can grow, since the very beginning of eBay, since you brought up cars, eBay Motors was a picture of a car and some HTML code. People that were early eBay users will remember that you couldn't just type in your description into the template. You actually had to HTML code it. And if you coded it with the wrong code and you wanted it to be in black but you didn't use the right code, it would be in pink. And you wanted it to be in sans serif, it might show up in some other way and the picture might be vertical versus horizontal. It was just really messy and didn't work. And so if you think about what we call the democratization of trust, which is how marketplaces get velocity, and eBay didn't have a lot of that trust. And so people really wouldn't buy a car from, if I'm here in Utah and somebody was looking at it in San Francisco, they wouldn't do that. So eBay started to put things, what were called trust enablers, in place. And a trust enabler, you would know, and I'm just using your experience and thoughts about automotives, you would know a trust enabler as CARFAX, transportation, video inspection, money- back guarantee, financing, all of that infrastructure that came in. That created trust for someone to purchase a car from one location to another sight unseen and get that delivered is what created the eBay Motors marketplace. And people don't realize that eBay started with no car sales, and today they've sold over 5 million cars. And another early adopter of marketplace automotives was Autobytel run by a friend of mine named Mark Lorimer. And those two companies really created the entire online marketplace experience that we all enjoy today. It all started there. So eBay, now to specifically answer your question, said, " We're going to play in healthcare," but the biggest restrictor of healthcare on eBay is manufacturers and service providers don't want their products being associated with eBay. And so for the most part, they wouldn't use it because they didn't want their products up there. And frankly, a lot of manufacturers today will create barriers for resellers to put their products up there, because they don't want to be associated with that practical collectible fashion branding or attachment. And so eBay somewhat is restricted both internally but also from a marketplace standpoint. But as marketplaces like ours and others get legitimacy within healthcare, you're going to see that happen. And when you think about how these work, eBay is mostly what we call, and you may know this phrase, called spray- and- pray. Spray with Windex and pray that it works. And that is not a regulated process. And we're going to see, if you think about how fast this is going to happen and how lack of regulatory oversight exists, I just think the industry isn't really ready for what's about to happen.

Etienne: I'm thinking of a few scenarios myself. Okay, if I could go online and buy a used medical device, I don't know for sure it works unless it comes with a DMR, like a recent inspection and so forth, things like that, which, yeah, I could see a lot of holes in whatever might currently pop up. So as a manufacturer, then, I can identify with them saying, " Hey, I don't know that I want, maybe not so much new, but any of my older products, because that is eventually going to be traced back to me, whether it's through adverse events that do a poorly refurbished item." Of course, then you start getting into right to rework, things like that. I'm curious, so what is the path forward then? So if I'm a manufacturer, knowing that this is coming at some point, what advice would you have for maybe even early- stage company to prepare for some of these things?

Scott: Great question. So I think there's something I would want to have people consider before I answer the question, which is the common position of leadership in manufacturing, mostly now speaking of devices, obviously we can't reuse pharma or we can't reuse gauze, but mostly devices at this point in this particular question and answer, is that the manufacturer wants to be, you know, " We're going to restrict the resell of these devices in some way by creating barriers to get service and support, to create recertification fees, to get that device back into our system so we can support it." There's been all kinds of, in my view, illegal, unjust, unethical, predatory barriers that healthcare manufacturers have created and put in place to restrict the resell. However, what they're missing is that if you think about it from a practical standpoint, most service of medical devices is done by third parties, not by the manufacturers. And hospitals now, as part of their budgetary process, are actually putting in the resell of their hospital beds, their CTs, their PET scans. These things are going back into North American markets. They're getting money for them. They're being redeployed into the secondary market. There's very few, just using a category, ultrasounds that aren't used and then resold and being used again. And if we didn't have secondary market service and the resell of devices currently in the US as much as the manufacturers try to restrict it, we probably wouldn't be able to afford healthcare. If you think about it, there'd be such a monopoly on the price of devices by the manufacturers and the monopolization of service, they would basically be able to charge whatever they wanted. The only restriction would be the other manufacturers that may keep their pricing and service lower and better. But we're going to have products being resold into the US and around the world. It's just going to keep happening. And so I think we just have to recognize that this is here. It's going to stay. It's not going away. When you have, in my world, an aesthetic device that really on average is new, 100,000 physicians, clinicians cannot buy those and just take$100, 000 losses if it doesn't work for the clinic for some way, whether it's they bought the wrong device, not the right patient mix, lost their technician, went in a different direction, their practice got bought. Whatever it might be, those devices need to get redeployed, otherwise the impact to the practice would be substantial. Now to answer your question, we're going to see the reprocessing of devices being done through facilities such as ours, which makes sure that these devices go back into the space meeting manufacturer specifications that are safety inspected, that are biomedically tested on testing equipment that's been certified in date, where the process is videotaped and photographed and documented, where the end user now of that second market device has confidence that that device is currently meeting manufacturer specifications, no different than if a third- party service provider came in and serviced something on a hospital or a clinic's platform as they do today to make sure that they're treating patients safely and effectively. So these trust enabler platforms, going back to what I was explaining about eBay Motors, you're going to see reprocessing centers that sit in between the resell of devices that are charging for that service but aren't necessarily taking title to make sure that that device is being delivered and it meets manufacturer specifications.

Etienne: Okay, that makes sense. So you still have full traceability all the way back to the beginning, I assume, and I need to correct what I said earlier about DMR. I think I meant DHR, updating that and having that full traceability record. So really, it almost sounds like when you're developing a device, if I were to translate this a little bit, tell me where I'm missing the mark, if I'm developing a device in today's world, I need to be thinking about the full life cycle, not just, okay, it's in the market and I'm waiting to hear maybe whatever feedback I get from the market. I need to be thinking about the potential of resale and reprocessing, refurbishing all the way through, essentially. I mean, it's a little bit more than maybe it used to be or, I don't know, maybe I'm missing that.

Scott: No.

Etienne: Any thoughts?

Scott: No, I think, again, you just made a point, is that I do interviews and talk to people and build up our platform, is getting the industry to think about, if you're a manufacturer even of a consumable that have an expiration date, if those consumables aren't being used, they're probably going to be used even though they're expired and in some secondary market, or they may just be used in a primary market with the expiration date known because of the cost control. And now, if you think about it, we know we're going to face recessionary pressure. Whether it's one month or one year or 10 years, nobody really knows. But we know that industries move in cycles, and we know that budgets move in cycles, and we know economies move in cycles. When the economy starts to get rattled, capital spend or any spend, discretionary spend, is reduced, and that forces more service, the resell of devices to recover capital, to buy pre- owned at a discount, to add that technology or replace that technology or to back it up. So you're going to see actually another acceleration of this market and also marketplaces trying to find ways to reduce costs to clinicians and administrators because of now an add- on to the pandemic, which is now recessionary pressure. So manufacturers need to be thinking about the entire life cycle, not the first user, which they typically are focused on from a regulatory standpoint. They're now going to be thinking about, this product actually is going to be in the channel for probably 15 to 25 years. There are energy- based devices and aesthetics that are 20 years old that are still being used today and being bought and sold globally. And manufacturers ignore it, like, " Oh, we're not going to service it anymore." But there is a very healthy and robust secondary market parts business, OEM equivalent manufacturing of those parts, ongoing training and education, certification of these 20- year- old technologies. And I think manufacturers need to change their position and think about the profitability of maintaining and supporting that through the channel and the life of the product in the channel.

Etienne: That's a great point. You've given me flashbacks to a previous life. I worked as a manufacturing engineer, worked on neurosurgical equipment for cranial stabilization as well as stereotactic surgery. And some of those were legacy devices that were 20- plus years old. And the thought occurred to me working there, when we get things that had been, yeah, they were basically done, we were done reprocessing them for whatever reason we retire a product, whether it's$ 100,000- plus or whatever, I would think about these other countries even or other places that don't have access to this high equipment. And this maybe goes into a different direction, so if this is totally off topic, please pull me back. My wife and I had the opportunity in 2016 to volunteer in Africa. And my wife is a critical care nurse. So we went to Malawi, which I think is the third- poorest country in the world, and she volunteered at a hospital that, according to her, she was using equipment that she had only seen in her historical textbooks, stuff from the'80s. And they don't have access to a lot of the things that we might even just throw away. Everything was expired. You mentioned the gauze and so forth, secondary markets. And if this is off topic, that's fine. But I'm curious, is this also building into something that could be helping these additional industries, where if we think a little bit more about the used market, for lack of a better term, is there somebody thinking about that, and how should we be thinking or treating those things from a global standpoint?

Scott: Well, I think you bring up really an interesting topic in talking about devices into secondary and other downstream, even beyond the traditional secondary markets, the really rural, impoverished marketplaces that currently exist around the world where you're going to see devices. When there was that large explosion in Lebanon, little over a year and a half ago I think now, there was a lot of movement of technology, pre- owned, going into the market to take care of injured patients. I think you're going to see the same thing throughout Eastern Europe and Ukraine where, as that country rebuilds and people need to, especially in energy- based devices and what we do, you're going to see a large migration of this technology, not new, but pre- owned, going in there to treat patients and casualty victims or injury victims. So these devices are going to continue to go into primary markets and to these secondary markets, and I don't believe that the industry realizes how large this industry is and what's happening. And if you think about from this perspective, you can't find a capital market that doesn't embrace the secondary market. And I'll explain. Let's use Viking boats. If it wasn't for pre- owned Viking boats, they probably wouldn't sell a lot of new Viking boats. And because the cost of a big expensive boat is prohibitive to many people, they want to get on that path to having that experience of purchasing something, if that's what they choose to have. And they start out with something that might be 10 or 20 years old or even older than that. Let's look at Tesla, for example. If it wasn't for the ability to resell Teslas, no new Teslas would get sold. It just wouldn't happen. And so what about jets or washing machines or, I mean, how about computer equipment or cell phones? Lots of people have secondary market cell phones. Apple buys them back. It's pretty remarkable that we see this in every aspect of our life, but it's not really recognized in the healthcare devices and pharma and med surg, and I think that's what you're asking. It's massive. And with the compression of the supply chain and the sale of products and services, a lot of the friction and inefficiency is going to go away and this is going to explode.

Etienne: There needs to be specific regulation, it sounds like, maybe to curb the bad players in the market, for example. Do you have any specific thoughts on what that regulation would look like or, voice of the industry, what you see being a practical application of regulation in this context?

Scott: I think we, and this is probably surprising that I would say this to a lot of people, but I think we need more regulation and we need it fast, and we need it very, very quickly, redundant very quickly and very, very fast. And I don't think it's limited to just the bad actors. I think it's keeping an honest industry honest. I think oversight when it comes to patient experience and safety and care is paramount. I just don't think there is any at the level that it needs to be. I mentioned earlier the resale of devices through Alibaba counterfeits, for example. We have to be so, so careful that we're treating human beings, and in many cases we don't even know what we're treating them with if they're not properly serviced, tested, and transported and installed and safety inspected on site and recalibrated. The injury to patients is going to be astronomic, and the cost and litigation is going to be unprecedented. So we need regulation now more than ever to make sure that the industry continues to stay safe for those patients that are being treated with these devices.

Etienne: Yeah, and I can think of a very specific example even of that. I mean, when I was working with 303 stainless steel, it reacts a little bit differently if you passivate it, nitric passivator or citric passivator. So you get a little bit difference there. I mean, it's slight, but certainly you need to check those biocompatibilities if you just order something from Alibaba. I can see where you come from exactly. This is really good. This is eye- opening to me a little bit. I've never really thought about those secondary or downstream markets from this standpoint. Any other thought... I know we didn't get to talk a lot about the aesthetics, which is... I know you are a leader in the field of aesthetics. Did you have some things you'd like to mention about that? Just a little education for the industry or any thoughts?

Scott: Well, yeah, I think there's some things that aren't really relevant to share with the... Aesthetics is probably a small subset of your audience.

Etienne: Sure.

Scott: But I think that what we're doing here is really important for your listeners and watchers to understand, because they're going to be thinking about it soon. I happened to be in Scotland this past month at an investment banking summit, and I was speaking to a gentleman that's one of the largest manufacturers with Envision. And he was telling me that they had brought their leadership from around the world into the Netherlands for a meeting, about just a sense that they think something's changing in the way they're distributing products, but they really couldn't put their finger on it. And they actually got together and actually left with no solutions. They just know something's happening, but they really couldn't put their finger on it. And so I explained to them what we're doing and what we're thinking. And I think it's going to become a trend, and not necessarily exactly what we're doing, but people will start to appreciate it. And that is that when we decided to build a healthcare marketplace, which is our ultimate objective... And for those of you who don't know, we currently have, for example, 60,000 McKesson SKUs. We're very close to having all McKesson SKUs up on the platform in the next few weeks, and being a reseller for McKesson of pharma and med surg and non- prescribed items. And so we're really trying to find ways to aggregate viewership, buyers, administrators, clinicians, and give them good, better, best pricing, lowest cost, peer- to- peer reviews, the things I mentioned earlier. But we knew that we couldn't do this in all markets. I mean, you could quickly, you and I, identify 40 to 50 capital markets, imaging, for example, and then subsets of imaging from CT, MRI, PET, ultrasound, rad. You could go to IV pumps as a category. You could go to anesthesia and monitoring as a category, diagnostics, whether you go hematology or chemistry. I mean, the capital market segments are gigantic. The subsets within those are gigantic. We decided to focus on aesthetics because of three primary factors in building a marketplace. We wanted to enter in a market that we knew was growing year over year, and aesthetics is in spite of economic pushback and recessionary pressure. We wanted something that was cash- based because marketplaces like cash. And for example, if a hospital buys IV pumps, they buy them with POs, not with cash. And so marketplaces, we wanted to test our thesis with a cash- based sector, not a PO- based. And the other thing is aesthetics is very emotional, and marketplace adoption likes emotion. And I'll give an example. Buying an IV pump is generally not emotional, but buying a hair removal device, a lot of different manufacturers, there's a lot of complexity and differentiation. It's highly emotional having that best technology in the practice from a branding and patient awareness standpoint. So we entered there and we then set out to say, " Okay, we're going to have to create trust enablers similar to eBay if we're going to get people to make that transition." And trust enablers, we've identified in our market eight, and I'll cover a couple of them. One of them was a processing center. So we currently have more biomedical engineers in our facility than most manufacturers processing pre- owned devices. There's over a thousand pre- owned devices that we own in our facility that range anywhere from$5, 000 to over$100, 000. We have over 10, 000 hand pieces, parts, and peripherals. And we used this to be able to deliver great customer experiences. And actually, this month we're going to start allowing our first resellers on the platform, and they'll have to use our processing center, our trust enabler, to make sure that we're delivering that experience that the customer, the clinician administrator expects. We had to build an Uber and Angie's platform for Texan trainers, because you can't just keep flying Texan trainers. You needed some form of regionalization of the deployment of that technology installation and then training, and to bring that cost down. So we currently have 750 domestic technicians and trainers and an Angie/ Uber platform where we can deploy technicians or trainers on a regional basis at a lot less cost with certification, with reviews. We had to build an IMS for inventory because we clearly couldn't own all the inventory. A lot of people didn't want to list their inventory on the platform initially. We didn't allow it, so we had to find where all that inventory was. It was sitting on the sidelines. So we started to build these things that ultimately would bring adoption and velocity to the platform and then experience when they made that purchase would be similar or better than what they got from an original manufacturer. So we've been in the process of building those things, and I think that's what you're going to see in sub- sectors throughout medical devices and pharma, are similar platforms that we've created that have those trust enablers that allow, as I said in the very beginning, the reduction of 40% to 50% of the cost and really transferring that to the buyer.

Etienne: The trust enablers. That was the question I was going to have but you answered it, and that is that certification of the reprocessing, that Angie's List, Uber- type certified person who does those things. That's very interesting. I can definitely see that being a disruptor. Very cool.

Scott: Well, it's been great being on, and hopefully some people will get some... at least get them thinking about things a little bit.

Etienne: Yeah.

Scott: I'm hopeful.

Etienne: Yeah, this is good. I really appreciate it. We'll put a link in the show notes so that people can find you and what you're doing, see a little bit more about how you guys are approaching this problem. Very much appreciate the work you're doing. Any last thoughts for our listeners?

Scott: I guess I have one, which is, and I said this I think a couple of times, is if you just stop and step back and think about how everything in our lives is purchased and how everything in this industry is still sold, that will trigger some of the thinking that maybe something significant is going to happen. And if you want to maintain or grow your position in the market, there's never been a better time than to do it right now. And I see older leaders still doubling, tripling down on trade shows and events and field sales reps, and it's just not going to work.

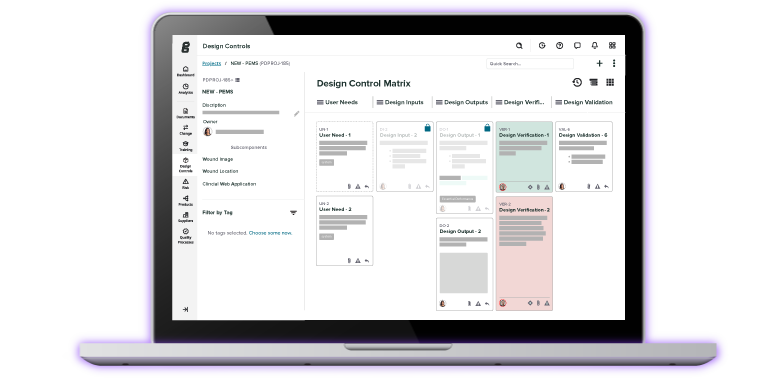

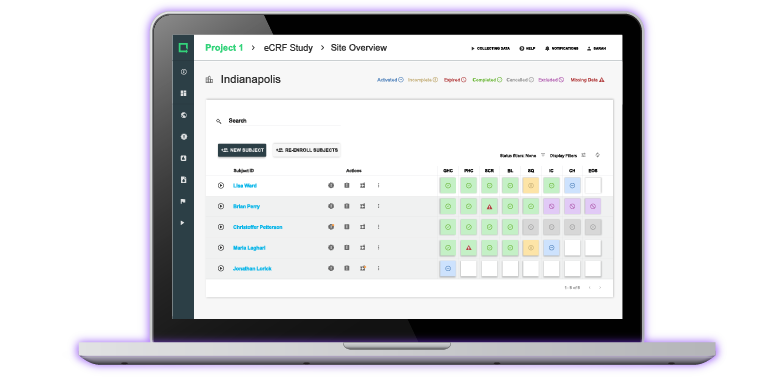

Etienne: All right. Well, definitely a lot of food for thought. Thank you so much for being on the show, Scott. Those of you who have been listening, you've been listening to the Global Medical Device Podcast. We hope you enjoyed this episode as much as we enjoyed making it, and we will see you next time. Thank you so much for listening today. Just a few of the points I took away from the conversation were, there are already facilities working towards reprocessing these devices to ensure devices meet manufacturer specifications. Scott talked a little bit about how the selling of these devices is changing and how buyers themselves, their behavior is changing. It's starting to come over and cross over into the healthcare and the medical device world as well. I encourage you to go check out what Scott is up to at Powered by MRP to learn more. If you enjoyed this episode, reach out to Scott on LinkedIn. Tell him what you thought, and let him know. Also, I'd personally love to hear from you via email, etienne.nichols@greenlight.guru, or look me up on LinkedIn. You can learn all about what we're doing if you head over to www.greenlight.guru. We're the only med tech lifecycle excellence platform. And on top of that, we've built both a community and an academy where you can go to join the conversation or learn more about the things we discuss on this podcast. You can find both of those at www.community.greenlight.guru or www.academy.greenlight.guru. Finally, if you enjoyed this show, please consider leaving us a review on iTunes. It helps people find us. It also lets us know how we're doing. We love hearing that feedback. Thanks again. Appreciate you listening. You're the best.

About the Global Medical Device Podcast:

The Global Medical Device Podcast powered by Greenlight Guru is where today's brightest minds in the medical device industry go to get their most useful and actionable insider knowledge, direct from some of the world's leading medical device experts and companies.

Etienne Nichols is the Head of Industry Insights & Education at Greenlight Guru. As a Mechanical Engineer and Medical Device Guru, he specializes in simplifying complex ideas, teaching system integration, and connecting industry leaders. While hosting the Global Medical Device Podcast, Etienne has led over 200...