5 Steps to Faster-to-Market, More Profitable Medical Devices

Healthcare provider market demands are such that medical device companies often find themselves in scramble mode when attempting to deliver innovative products that keep pace with burgeoning technology developments and are compliant with regulatory requirements.

In response, many companies look to manage production, shorten lead times, and lower costs, as well as improve their competitive edge through collaborative partnerships and outsourcing, but this is no longer sufficient to meet the increasing market demands.

So, what are the critical factors for success in product development — specifically, factors that will improve speed-to-market and profitability?

PA Consulting Group recently surveyed 40 senior executives and representatives of medical device developers in the U.S. and Europe on the topic. Respondents were asked to evaluate their own company’s status and planned improvements, as well as their view of competitors’ time-to-market and cost-to-market.

Slightly more than half of the participants represent medical device technology companies (55 percent), while the remainder hailed from pharmaceutical companies with a medical device division. More than half of the companies (57 percent) in the research reported revenue of more than $5 billion in 2014, designating them as “important players” in the industry. Regardless of the company size, respondents, on average, are targeting a 25-percent reduction in both development time and development/production costs, over the next five years, to remain competitive.

While product innovation in medical devices was the top priority for companies seeking to bolster business — according to 66 percent of respondents — reducing time to market followed closely as a principal issue for 56 percent of the survey participants. Many respondents said they aim to accelerate their time-to-market efforts in the next five years, with the top levers toward achieving that goal being reuse of technology, focusing on core competencies and outsourcing other activities, managing strategic partnerships, efficient resource planning, and modularizing/standardizing parts and systems. Conducting risk evaluation early in product development also was a focus of respondents, since that foresight may help reduce the number of testing loops in advance of patient trials and studies.

One proven efficiency strategy is better reuse of technology, such as standardizing parts and systems, and reusing components, leading to simplified (and less time-consuming) regulatory and validation processes. Another efficiency approach that respondents discussed is improvement of sourcing via outsourcing services that fall outside the company’s core competencies.

Through strategic partnerships, companies may grow beyond their own realms of expertise, in some cases collaborating with technology groups in the software and consumer electronics sectors. Verily’s recent partnership with Nikon and Medtronic’s deal with Fitbit are good examples of this approach. Other strategic partnerships allow medtechs to focus on their core competencies while managing outsourced suppliers to handle prototypes, production, or distribution.

For most respondents, the proportion of in-house and outsourced activities at their companies was mixed. Half of the respondents reported that reducing time-to-market and cost-to-market is achieved by focusing on product innovation and development, as well as marketing and sales, while outsourcing other activities. Similarly, they aim to improve the management of their outsourced partners and suppliers. PA Consulting recommends that companies aim for an outsourcing level of between 30 and 50 percent, combined with less than 30 percent mixed activities, and the balance completed in-house.

One way to reduce mixed sourcing is to increase the level of outsourcing, typically manufacturing and development of component prototypes. Additionally, market insight across multiple regions can be outsourced to gain on-the-ground feedback without affecting the product’s intellectual property. However, more specific user insight data should remain in-house, because it may generate ideas for product improvement.

Three proven strategies that surprisingly few participants recognized as viable tactics to build competitive advantage are design-to-cost, value engineering — a best practice from the automotive industry — and early systems integration.

-

Design-to-cost is exactly what it sounds like: engineers are tasked with designing a product within a certain budget or cost range. Engineers may be keen to design fancy new features, but an understanding of the cost implications at each design stage, and the ability to search for the lowest cost impact while meeting design, quality, regulatory, test, etc. requirements is at the heart of design-to-cost.

-

Value engineering/ value analysis evaluates your products from a value perspective, analyzing how much each function costs and how much value it brings to the customer.

-

Early systems integration describes the ability of companies to integrate, early in product development, different functional disciplines. These components and disciplines include hardware, software, mechanical and electrical components, drugs and devices — originating both within the company and from suppliers. Such companies discover much sooner in development any obstacles or challenges in design and functionality. Often, testing system integration is done too late in the development process.

PA Consulting anticipates that these approaches will play a more significant role in the future. Companies that are able to adapt and progress will ultimately shorten time-to market and lessen cost-to-market.

Moving on to self-evaluation, changing or unclear internal priorities were areas of concern for about 70 percent of respondents. By creating early testing loops and improving supplier management, companies can address these issues, clarifying management priorities in the preliminary stages of product development. Setting more specific project development goals for schedule, cost, and scope, as well as integrating technical project managers and interdisciplinary teams, also will yield improvements.

In addition to priority confusion, company representatives assessed their development capabilities as rather mediocre, on average. They consistently rated their competitors’ capabilities higher than their own, except in R&D. Overall, an analysis of responses among the survey’s “important players” — companies among respondents that had the highest revenues — shows a large gap between respondents’ views of their own capabilities, their estimate of competitors’ capabilities, and actual best practices.

In all, there are five principal areas where medical device developers need to focus to achieve their goals of reducing time-to-market and cost-to-market while fostering innovation and remaining compliant:

-

Identify core competencies — Define where companies need to excel to remain competitive. Set clear targets and prioritize these as part of the business strategy;

-

Select collaboration partners — When managing suppliers and partners, exercise excellent technical and commercial knowledge and project management skills;

-

Foster smart innovation — Smart innovation means designing a device that is innovative in the eyes of the market decision-makers, and envisioning a future world where the device will be used;

-

Deploy integrated product development processes — Modularize the development process and find a good balance between agility, lean, and compliance with early integration of all related functions;

-

Introduce a culture where time, cost, and innovation are in focus — Measure time, cost, and innovation deliverables. Train employees in reusing technology and cost awareness while affording room to innovate.

Medical device and pharmaceutical companies that undertake these five strategies will reduce time-to-market, lower costs, and improve relationships with collaborators and sourcing partners, leading to innovations that are responsive to the ever-changing healthcare market.

This article first appeared in Med Device Online and published on PA Consulting blog.

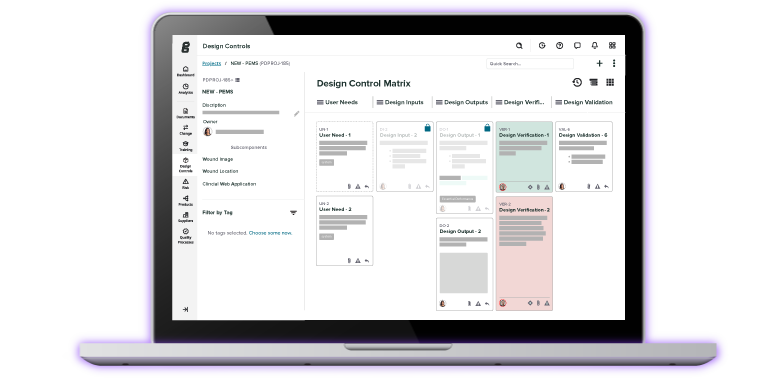

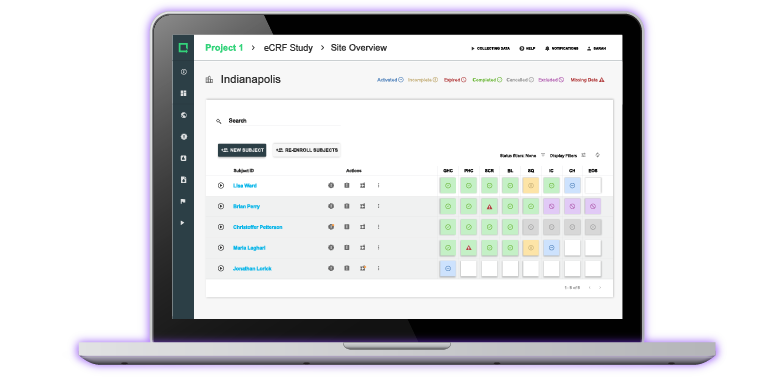

Looking for a design control solution to help you bring safer medical devices to market faster with less risk? Click here to take a quick tour of Greenlight Guru's Medical Device QMS software →

We believe in the power of ingenuity to build a positive human future in a technology-driven world. As strategies, technologies and innovation collide, we create opportunity from complexity. Our diverse teams of experts combine innovative thinking and breakthrough use of technologies to progress further, faster. Our...